Comprehensive Guide To Wells Fargo Notary Service Fee: Everything You Need To Know

Wells Fargo notary service fee is a crucial aspect to consider when seeking notary services through one of the largest financial institutions in the United States. Whether you're finalizing important documents, securing loans, or processing legal paperwork, understanding the costs involved can help you plan your finances effectively. In this article, we will explore everything you need to know about Wells Fargo's notary services, including their fees, availability, and additional resources that may assist you.

As one of the leading banks in the country, Wells Fargo offers a range of services designed to meet the needs of its diverse clientele. Among these services is the provision of notary services, which are essential for authenticating documents and ensuring their legality. Knowing the Wells Fargo notary service fee can help you avoid unexpected costs and ensure a smoother transaction process.

In the following sections, we will delve into the specifics of Wells Fargo's notary services, including how much they charge, where you can access these services, and what types of documents require notarization. By the end of this article, you will have a thorough understanding of the Wells Fargo notary service fee and how it fits into your overall financial planning.

Read also:Kathy Nolan Actress Unveiling The Talented Performers Journey

Table of Contents

- Introduction to Wells Fargo Notary Services

- Understanding Wells Fargo Notary Service Fee

- Where to Access Wells Fargo Notary Services

- Types of Documents That Require Notarization

- The Notarization Process at Wells Fargo

- Wells Fargo vs Other Banks' Notary Fees

- Tips for Reducing Notary Costs

- Legal Considerations for Notarization

- Frequently Asked Questions

- Conclusion and Next Steps

Introduction to Wells Fargo Notary Services

Overview of Wells Fargo Notary Services

Wells Fargo offers a variety of banking and financial services, including notary services. These services are designed to assist customers in authenticating legal documents, ensuring their validity, and meeting regulatory requirements. The bank's commitment to customer satisfaction is evident in the accessibility and convenience of its notary services.

Notary services are an integral part of many financial transactions, from mortgage agreements to power of attorney documents. Wells Fargo's notary services provide a reliable and professional option for individuals and businesses seeking to notarize their documents.

Why Choose Wells Fargo for Notary Services?

There are several reasons why customers choose Wells Fargo for their notary needs:

- Convenient locations across the United States

- Trained and certified notary professionals

- Competitive Wells Fargo notary service fee

- Integration with other banking services

Understanding Wells Fargo Notary Service Fee

One of the most frequently asked questions about Wells Fargo's notary services is related to the Wells Fargo notary service fee. While the exact cost may vary depending on the location and specific services required, Wells Fargo generally charges a competitive rate for its notary services.

Standard Notary Service Fee

The standard Wells Fargo notary service fee typically ranges from $10 to $25 per signature. However, it's important to note that this fee may differ based on state regulations and the complexity of the document being notarized. Additionally, some locations may offer promotions or discounts, so it's always a good idea to check with your local branch for the most accurate information.

Read also:Eva Pepaj The Rising Star Redefining Albanian Music

Factors Affecting the Fee

Several factors can influence the Wells Fargo notary service fee, including:

- The number of signatures required

- The type of document being notarized

- State-specific regulations

- Additional services, such as mobile notary services

Where to Access Wells Fargo Notary Services

Branch Locations

Wells Fargo notary services are available at most of its branches across the United States. To find the nearest location offering these services, you can use the bank's online branch locator tool or contact customer service for assistance. It's always a good idea to confirm the availability of notary services at your preferred branch before visiting.

Mobile Notary Services

In addition to in-branch notary services, Wells Fargo may also offer mobile notary services for customers who require notarization at a location other than a branch. This service may incur an additional fee, so it's important to inquire about the costs involved when requesting mobile notary services.

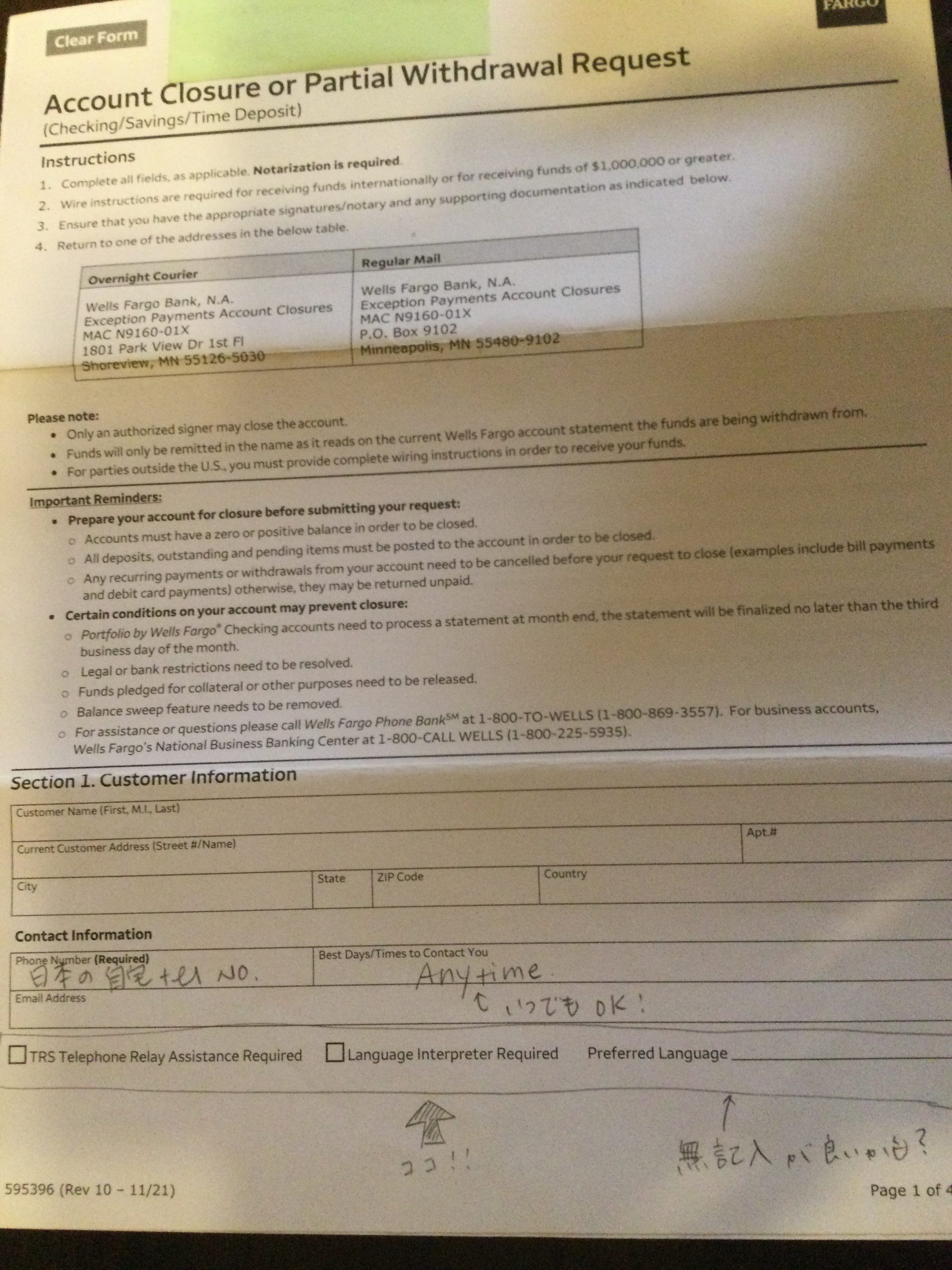

Types of Documents That Require Notarization

Notarization is required for a wide range of documents, including but not limited to:

- Real estate deeds and mortgages

- Powers of attorney

- Wills and trusts

- Loan agreements

- Business contracts

Understanding which documents require notarization can help you plan ahead and avoid delays in your transactions. Wells Fargo's notary professionals can guide you through the process and ensure your documents are properly authenticated.

The Notarization Process at Wells Fargo

Steps to Notarize Your Documents

The notarization process at Wells Fargo typically involves the following steps:

- Schedule an appointment at your local branch

- Bring the necessary documents and identification

- Review the documents with the notary professional

- Sign the documents in the presence of the notary

- Pay the Wells Fargo notary service fee

What to Bring to Your Appointment

To ensure a smooth notarization process, make sure to bring the following items to your appointment:

- The documents requiring notarization

- Valid government-issued identification

- Payment for the Wells Fargo notary service fee

Wells Fargo vs Other Banks' Notary Fees

When comparing Wells Fargo notary service fee with other banks, it's important to consider factors such as convenience, service quality, and additional offerings. While some banks may offer free notary services to account holders, Wells Fargo's competitive pricing and extensive network of branches make it a strong contender for notary needs.

Free Notary Services

Some banks, such as Chase and Bank of America, offer free notary services to their account holders. However, these services may come with restrictions, such as requiring a minimum account balance or specific account types. Wells Fargo's notary services, while not free, offer flexibility and reliability without such limitations.

Tips for Reducing Notary Costs

While the Wells Fargo notary service fee is generally competitive, there are ways to reduce the overall cost of notarization:

- Check for promotions or discounts offered by Wells Fargo

- Bundle multiple documents into a single notarization session

- Consider alternative notary services, such as mobile notaries or online notarization

Legal Considerations for Notarization

Notarization is a legal process that requires strict adherence to state and federal regulations. Wells Fargo's notary professionals are trained to ensure compliance with all applicable laws, protecting both the customer and the institution from potential legal issues.

State-Specific Regulations

Each state has its own rules and requirements for notarization. Wells Fargo's notary services are designed to meet these regulations, ensuring that your documents are properly authenticated and legally valid.

Frequently Asked Questions

How Much Does Wells Fargo Charge for Notary Services?

The Wells Fargo notary service fee typically ranges from $10 to $25 per signature, but this may vary based on location and specific services required.

Do I Need an Appointment for Notary Services at Wells Fargo?

While walk-in notary services may be available at some branches, it's always best to schedule an appointment to ensure availability and minimize wait times.

Can I Use Wells Fargo's Notary Services Without Being a Customer?

Yes, Wells Fargo's notary services are available to both customers and non-customers, although fees may apply.

Conclusion and Next Steps

In conclusion, understanding the Wells Fargo notary service fee and the services offered can help you make informed decisions when it comes to notarizing important documents. With its extensive network of branches, trained notary professionals, and competitive pricing, Wells Fargo provides a reliable option for notary services.

We encourage you to take the following steps:

- Visit your local Wells Fargo branch to learn more about their notary services

- Review the types of documents that require notarization and plan accordingly

- Share this article with others who may benefit from the information

For more information on financial services and tips, explore our other articles and resources. Your feedback and questions are always welcome, so feel free to leave a comment or contact us directly.

Data Source: Wells Fargo Official Website